The Global History of Financial Bubbles: A Comprehensive Guide

Financial bubbles are a recurring phenomenon in economic history. They are characterized by a rapid and unsustainable increase in the prices of assets, such as stocks, bonds, or real estate. Financial bubbles are often fueled by speculation and euphoria, and they can end in a sudden crash, resulting in widespread financial losses.

The history of financial bubbles is long and complex. Some of the most famous bubbles include the Tulip mania in the 17th century, the South Sea Bubble in the 18th century, the Wall Street Crash of 1929, and the Dot-com bubble in the late 1990s.

In this article, we will explore the global history of financial bubbles. We will examine the causes and consequences of bubbles, and we will discuss the lessons that can be learned from them.

4.5 out of 5

| Language | : | English |

| File size | : | 2663 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 296 pages |

There are a number of factors that can contribute to the formation of a financial bubble. These include:

- Low interest rates: Low interest rates can make it easier for investors to borrow money to invest in assets. This can lead to increased demand for assets and higher prices.

- Speculation: Speculation is the buying and selling of assets in the hope of making a profit. When investors speculate on assets, they are often willing to pay more than the assets are worth. This can lead to a rapid increase in prices.

- Euphoria: Euphoria is a feeling of excessive optimism and confidence. When investors feel euphoric, they are more likely to take risks and invest in assets without carefully considering the risks.

- Lax regulation: Lax regulation can allow investors to engage in risky behavior without facing consequences. This can contribute to the formation of financial bubbles.

Financial bubbles can have a number of negative consequences, including:

- Economic damage: Financial bubbles can lead to economic damage by causing a sharp decline in asset prices. This can lead to a loss of confidence in the financial system and a slowdown in economic growth.

- Financial losses: Financial bubbles can also lead to financial losses for investors. When asset prices crash, investors can lose a substantial amount of money.

- Social unrest: Financial bubbles can lead to social unrest by causing a loss of confidence in the government and the financial system. This can lead to protests and even riots.

The history of financial bubbles provides a number of important lessons for investors and policymakers. These lessons include:

- Be aware of the signs of a bubble: There are a number of signs that can indicate that a financial bubble is forming. These include a rapid increase in asset prices, increased speculation, and euphoria.

- Invest wisely: When investing, it is important to do your research and understand the risks involved. Do not invest more than you can afford to lose.

- Be patient: Financial bubbles can last for a long time, but they always end eventually. Do not try to time the market. Instead, be patient and invest for the long term.

- Have a solid financial plan: A solid financial plan can help you to weather financial storms. Make sure you have a diversified portfolio and an emergency fund.

Financial bubbles are a recurring phenomenon in economic history. They are caused by a number of factors, including low interest rates, speculation, euphoria, and lax regulation. Financial bubbles can have a number of negative consequences, including economic damage, financial losses, and social unrest. The history of financial bubbles provides a number of important lessons for investors and policymakers. These lessons include being aware of the signs of a bubble, investing wisely, being patient, and having a solid financial plan.

The following is a list of some of the most notable financial bubbles in history:

- Tulip mania (1637)

- South Sea Bubble (1720)

- Wall Street Crash (1929)

- Dot-com bubble (1990s)

- Global financial crisis (2008)

Tulip mania was a speculative bubble that occurred in the Netherlands in the 17th century. The price of tulip bulbs rose to astronomical levels, and many people lost their fortunes when the bubble burst.

The South Sea Bubble was a speculative bubble that occurred in England in the 18th century. The price of shares in the South Sea Company rose to unsustainable levels, and many people lost their fortunes when the bubble burst.

The Wall Street Crash was a stock market crash that occurred in the United States in 1929. The crash led to the Great Depression, which was the worst economic downturn in the history of the United States.

The Dot-com bubble was a speculative bubble that occurred in the United States in the late 1990s. The price of shares in Internet companies rose to unsustainable levels, and many people lost their fortunes when the bubble burst.

The Global financial crisis was a financial crisis that occurred in 2008. The crisis was caused by a number of factors, including the subprime mortgage crisis and the collapse of the housing market. The crisis led to a global recession.

4.5 out of 5

| Language | : | English |

| File size | : | 2663 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 296 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Hakim Wilson

Hakim Wilson Darryl Cheng

Darryl Cheng Jamie Martin

Jamie Martin Steven John Tait

Steven John Tait Jennifer Bryce

Jennifer Bryce Tiziano Bellini

Tiziano Bellini Nancy Carey Johnson

Nancy Carey Johnson Fern Fraser

Fern Fraser Andrew Motion

Andrew Motion David S Brown

David S Brown Terry Mancour

Terry Mancour Chelsey Thompson

Chelsey Thompson Don Rich

Don Rich Kevin Johnson

Kevin Johnson Bobby Miller

Bobby Miller Nate Nelson

Nate Nelson Christopher Fry

Christopher Fry Jana Deleon

Jana Deleon Sakthivel Pannerselvam

Sakthivel Pannerselvam Pernille Rudlin

Pernille Rudlin

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jack LondonYou Can Never Leave: A Haunting Tale of Love, Loss, and the Unbreakable Bond...

Jack LondonYou Can Never Leave: A Haunting Tale of Love, Loss, and the Unbreakable Bond...

Mark MitchellThe Complete Works of John Greenleaf Whittier: Illustrated Edition - Delphi...

Mark MitchellThe Complete Works of John Greenleaf Whittier: Illustrated Edition - Delphi...

Ryūnosuke AkutagawaThe Odes of Pindar: A Comprehensive Exploration of Their Themes, Imagery, and...

Ryūnosuke AkutagawaThe Odes of Pindar: A Comprehensive Exploration of Their Themes, Imagery, and... Gabriel Garcia MarquezFollow ·14.3k

Gabriel Garcia MarquezFollow ·14.3k Robert ReedFollow ·10.5k

Robert ReedFollow ·10.5k Rudyard KiplingFollow ·14.2k

Rudyard KiplingFollow ·14.2k Geoffrey BlairFollow ·5.8k

Geoffrey BlairFollow ·5.8k Harvey HughesFollow ·17.5k

Harvey HughesFollow ·17.5k Grayson BellFollow ·18.6k

Grayson BellFollow ·18.6k Alvin BellFollow ·4.7k

Alvin BellFollow ·4.7k Giovanni MitchellFollow ·14.6k

Giovanni MitchellFollow ·14.6k

Barry Bryant

Barry BryantKnitting Pattern Kp190 Baby Sleeping Bags Sizes 3mths...

This easy-to-follow...

Rudyard Kipling

Rudyard KiplingFolk Music Arrangements of Bartók: A Musical Tapestry of...

Béla Bartók, the renowned...

Garrett Bell

Garrett BellThe Yellow House Memoir: A Literary Masterpiece that...

A Journey of Resilience,...

George Martin

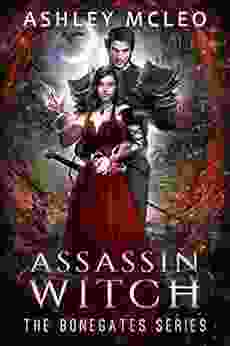

George MartinAssassin Witch Dark Faerie: The Bonegates

In the shadowy...

4.5 out of 5

| Language | : | English |

| File size | : | 2663 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 296 pages |